POLITICS

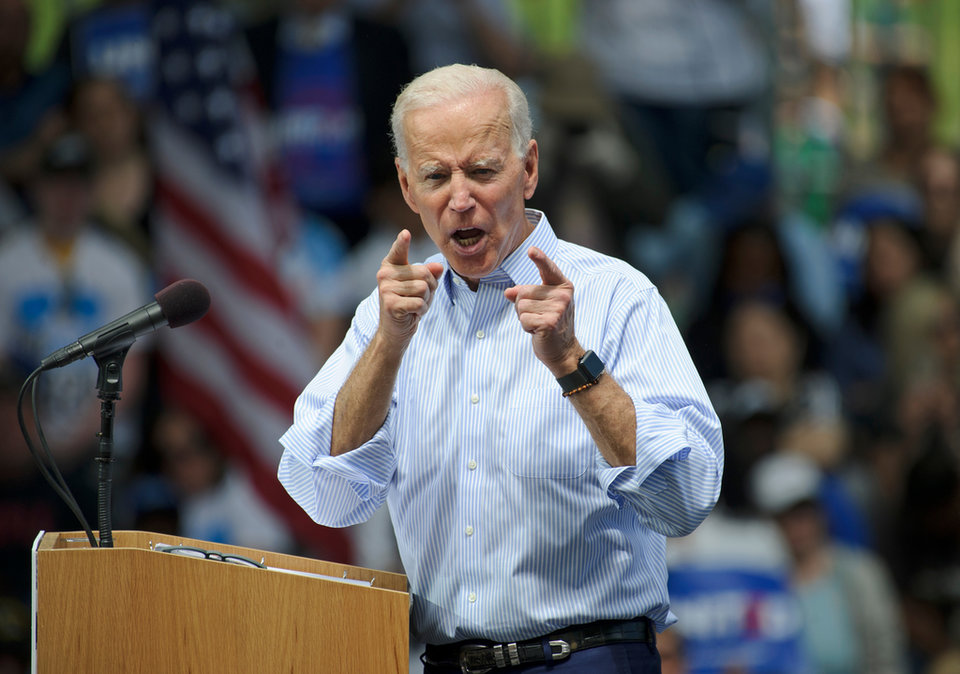

Joe Biden is president-elect: what now for US oil and gas?

The wait is finally over: Joe Biden has won the contentious 2020 US elections. He will be a very different leader to self-proclaimed ‘oil man’ Donald Trump, that we know, but what exactly can the offshore oil and gas sector expect? Heidi Vella reports.

A

fter a tight race that took several, agonisingly long days to deliver a result, Democratic Party nominee Joe Biden has been declared the new president-elect of the United States of America.

Former vice president to Barack Obama, Biden is the polar opposite to incumbent leader and self-proclaimed oil man Donald Trump. For this very fact, Biden’s election is expected to shake up the US oil and gas industry, which is already reeling from plunging prices and unprecedented uncertainty due to the Covid-19 pandemic.

Just as his predecessor spent a significant chunk of his time in office overturning Obama-era carbon reduction-targeted policies, such as green-lighting controversial oil pipelines and reversing emission restrictions, Biden is expected to use his first 100 days overriding Trump’s fossil-fuel focused policies with executive orders.

Biden has already stated that one of his first acts will be reinstating the US into the Paris Climate Change Agreement, which Trump pulled the country from when he took power in 2017. However, despite his dramatically different agenda, a Biden presidency may not be all doom and gloom for the US oil and gas sector.

Rolling back reforms

As well as putting climate change mitigation on the back burner, Trump pushed through notable tax reforms while in power, including reducing the federal corporate income tax by 14% through the 2017 Tax Cuts and Jobs Act. According to analysis by Rystad Energy, the effect of this policy was improved liquidity of oil and gas producers, reducing breakeven prices.

“Taking ExxonMobil’s US operations as a specific example, we estimate that in 2018 the company saved $193m in corporate tax, reducing asset breakeven oil prices by as much as 5.3%,” notes Matthew Wilks, an analyst on the North American shale team at Rystad.

Biden offers a return to the Obama administration’s strategy of using regulation to cut emissions

During his term, Trump also established a controversial oil and gas program in the Arctic National Wildlife Reserve in Alaska and replaced Barack Obama’s Clean Power Plan with the Affordable Clean Energy plan, which rolled-back regulations on emissions.

Trump winning, said Ed Crooks, vice chair, Americas, at Wood Mackenzie, would have seen more of the same. However, Biden will see a return to Obama era policies.

“Biden offers a return to the Obama administration’s strategy of using regulation to cut emissions, and more ambitious moves if the Democrats win control of Congress,” he said.

Regulatory overhaul

Under pressure to meet the aspirations of younger voters on climate change, in stark opposition to Trump, Biden has said he wants to put the US on a pathway to achieving net-zero carbon emissions by 2050 with a $2tn Clean Energy Plan that has been heavily influenced by the left of the democratic party.

Matthew Fitzsimmons, vice president of oilfield service research at Rystad, says that this would fundamentally change the energy landscape in the US.

“This ambitious strategy would cost the domestic upstream oil and gas industry greatly and propel green energy segments forward, changing the energy landscape,” he wrote in a briefing.

In particular, it is expected that the Biden administration will impose regulations to increase shale production costs with taxes and methane restrictions. Biden has proposed reversing part of the corporate tax cut, raising the main rate from 21% to 28%.

The deepwater Gulf of Mexico and the Permian Basin would remain highly competitive despite a carbon tax

This, Crooks says, will increase the federal government’s implied share of the total net present value of US oil and gas assets by about four percentage points. Goldman Sachs has estimated it could increase costs by as much as $5 per barrel.

However, tax and spending in the US is controlled by Congress and it’s not yet known if the Democrats have won a majority. If they do, Crooks says that Biden could be emboldened to follow in the footsteps of Europe and implement a carbon tax.

“The deepwater Gulf of Mexico and the Permian Basin would remain highly competitive despite a carbon tax. Most of the reserves that would be stranded would be in the Gulf coast and Rocky Mountain regions,” he says.

Reinstating restrictions

In his manifesto, Biden says he will protect the Arctic National Wildlife Refuge and ban new oil and gas permitting on public lands and waters and modify royalties to account for climate costs. Overall, he has promised to increase the consideration of “the effects of greenhouse gas emissions and climate change” in the federal permitting process.

Onshore, the impact of this approach will be minimal, says Crooks, but offshore it could be significant.

“A ban on new leasing, if permanent, would mean that, by 2035, US offshore oil and gas production would be about 30% lower than if lease sales had continued,” he explains.

Wood Mackenzie estimates there are nearly 25bboe that could be produced from the US Gulf of Mexico and federal areas in Alaska, including future discoveries from exploration.

By 2035, US offshore oil and gas production would be about 30% lower than if lease sales had continued

A ban on new leases, if permanent, “would lead to more than a quarter of that, about 7bboe, being left under the sea bed,” he adds.

Rystad says that they estimate there are 42.4 billion barrels of economically recoverable oil in Alaska and the Gulf of Mexico. If there were to be a ban on all new leases, the industry would effectively lose 16.2 billion barrels of oil. Stricter regulations, including a ban on exploration, would remove a further 6.1 billion barrels from licensed fields, while a complete ban on all drilling would remove another 13.7 billion barrels.

Furthermore, new hurdles are likely to be created for developers of oil and gas pipelines and export facilities.

Oil price and international relations

From sanctions on oil exports from Iran and Venezuela to trade wars with China, Trump had a huge impact on the international markets. Biden, on the other hand, is expected to see a return to diplomacy - and stability - in global relations.

He could oversee the US re-entering the Iran Nuclear deal and relaxing sanctions. Biden has been extremely critical of Trump’s decision to take the US out of the international deal regarding Iran’s nuclear programme. Analysts warn, however, that this move could see more oil enter an already flooded market, but it’s unlikely to be high on Biden’s agenda, given the ongoing Covid-19 pandemic and other challenges.

A potential end to the ongoing trade war with China would surely help support demand and oil prices

Conversely, increased taxes and regulation on US oil development could support the oil price by seeing less supply in the market. Wilks says that despite an overt perception that a Biden victory will mean the start of a difficult phase for the US oil and gas industry, the sector may actually benefit under a Biden administration.

“A potential end to the ongoing trade war with China would surely help support demand and oil prices. Similarly, an increase in measures to prevent the spread of Covid-19 would benefit oil prices in 2021–2022 in our view. A potential fracking ban on federal land would also most likely have a positive impact on oil prices in the short term.”

Furthermore, Crooks adds that a Biden victory, combined with Democratic control of the Senate, will likely result in greater fiscal stimulus for the economy, which could translate “to stronger economic growth and higher fuel demand”.

Good, bad or inevitable?

Having policy ambitions and actually enacting them in the US political system can be two very different things. As Crooks notes: “The US system of checks and balances means that Congress and the courts can make it difficult for presidents to achieve their goals. Market forces can ultimately be more powerful than any of them.”

And while a Trump victory would no doubt have been more supportive to oil and gas production, he could not have controlled all the market forces that are, arguably, heading in the trajectory Biden is set to take. The industry is looking at a lot of momentum towards cheaper renewables in the energy ecosystem and tighter controls over emissions and polluting sectors, such as oil and gas.

Companies will have to borrow more money or at a higher rate to develop an oilfield than a solar panel field

“The bigger point for oil and gas exploration overall is that as investors become more focused on environmental, social, and corporate governance, investment standards become more stringent, financing for many projects will be more difficult to obtain, or it will have more of a ‘sin’ premium, so to speak; companies will have to borrow more money or at a higher rate to develop an oilfield than a solar panel field,” says Daragh McDowell, head of Europe and Central Asia at Verisk Maplecroft.

“Market sentiment and regulatory requirements are going to be shifted by all of these things.”