Regional Focus

Could Greece beat the competition to become the major act in Eastern Med Gas?

Recent natural gas discoveries in the Eastern Mediterranean have renewed hope for development of offshore Greece, and talk of the country becoming a hub for the rest of Europe. But with stiff competition in the area, what needs to happen? Heidi Vella investigates.

Credit: Henning Flusund

I

n recent years, the Eastern Mediterranean has become a hot bed for offshore oil and gas activity, with several big natural gas finds offshore Israel, Cyprus and Egypt. This year alone, Exxon Mobil announced a notable find of approximately 5-8 trillion cubic feet (tcf) of gas offshore Cyprus and another, smaller find was made by Energean in March in Israeli waters.

These new discoveries show there is plenty of potential in the region, but perhaps nowhere more so than in nearby Greece. The country is expected to hold untapped oil and gas reserves in deepwater plays around Crete, where the government last year awarded several exploration licences to major companies, including Exxon Mobil and Total.

Greece is also blessed with an ideal geographical location. Unlike other countries in the region, who struggle to get gas to market, Greece’s proximity to the rest of Europe means it is well placed to quickly commercialise any new discoveries.

Greece’s gas potential

A big hydrocarbon find and a new export market could provide an invaluable economic boost to Greece’s struggling economy. As such, the government is keen to encourage new investment and activity in its offshore waters.

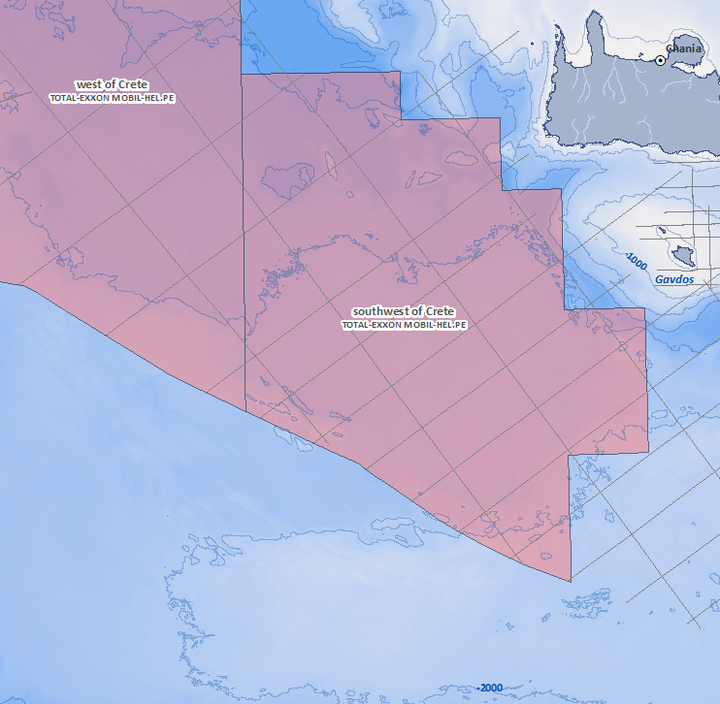

Currently however, Greece only has one block producing hydrocarbons offshore: Prinos, an aging field operated by UK-based Energean in the Gulf of Kavala, in the far north-east. But in a bid to revive the sector, in mid-2018, the Greek government awarded a contract to an Exxon-Total-Hellenic Petroleum consortium to explore in the West and South West of Crete.

The licences cover a huge area in very deepwater, averaging 3,200m. As yet, the potential of the blocks is unknown as there is very little seismic data available, but the geology is thought to be similar to that offshore Egypt where natural gas has also been found.

Robert Morris, a senior research analyst at Wood Mackenzie, says the presence of the major players like Exxon Mobil and Total suggests the blocks do hold promise.

The licences cover a huge area in very deepwater, averaging 3,200m.

“Cyprus is getting a lot of attention but it faces challenges getting its gas to market - but Greece is much closer to a very large gas market of mainland Europe; if a 4.5tcf gas field was found offshore western Greece it will be much easier to commercialise,” he says.

Proving the region is gaining favour with the majors, in April Spanish energy company Repsol and Greece-based Hellenic Peteroleum also signed lease agreements for exploration in an offshore block in the Ionian Sea. Hellenic will also carry out exploration in another block off the Peloponnese Peninsula.

Regional competition is stiff

While there have been several notable gas discoveries in the East Med - including Tamar (7-10tcf) and Leviathan (18.9tcf) fields in Israel and the Aphrodite (~7tcf) and Calypso gas fields in Cyprus, as well as the more recent ones - as noted by Morris, many face challenges commercialising amid challenging access to the European gas market and geopolitical tensions.

Cyprus, for example, is currently considering export opportunities to Europe via a new LNG plant or a new gas pipeline - both of which will probably require more gas to be discovered to make the investment commercially viable.

Whereas gas found offshore Greece, which borders Albania and Bulgaria, has an easy overland route to the rest of the European market, where gas is a core part of the energy mix.

While natural gas demand in Europe is levelling off amid more renewable energy production, supply is also declining. The EU currently imports about 20% of its gas needs, mostly from Russia, and is keen to find new supplies.

“The addition of an entirely new productive gas region would be huge news for Europe,” says Professor Kostas Andriosopoulos, an academic director at ESCP Europe.

“If we take into account Greece's proximity to the Balkan markets, dominated by Russian oil and gas, new discoveries would also bear fruit when it comes to their energy independence.”

Furthermore, Greece itself would benefit through the reduction of gas imports from places like Russia and Algeria, while local consumers could enjoy lower prices, he adds.

Image courtesy of Hellenic Petroleum

Ongoing Challenges

Despite all the promise, so far, not a single well has been drilled in the west and south west of Crete - so what is holding back serious activity?

Edgar van der Meer, senior analyst at NRG Expert, says investors may still be wary of the financial stability in the Greek economy, as well as the political risks, coupled with the unknown quantity and quality of potential resources, meaning investment in the area ‘is deemed risky.’

“Greece has had a very unstable political and economic climate, which has detracted and deterred foreign investment,” he says.

Another issue is a lack of momentum from the government, say Morris.

“When blocks are awarded they need to go through a ratification process to confirm the awards but that can take up to two years; it is not a fast process and there are many environmental and permitting considerations that add to the timeline,” he explains.

HHRM, the public authority in charge of hydrocarbons resources management, could use more support for staff and money too, says Andriosopoulos.

“Another important challenge is modernising the terms offered for future contracts to reflect the realities in the market; only then will investors be interested in hydrocarbon exploration and production in Greece,” he adds.

While the Greek government has acknowledged the importance of competitiveness and investment in its offshore energy sector, especially after the decade-long economic crisis, Andriosopoulos, says: “More political will is required to support the set goal of turning the country into an energy hub and realising the energy and climate goals for 2030.”

Competition from renewables is also heating up

Hydrocarbons also have competition in the region from renewables, for which Greece has great potential. The Greek energy and climate plan, published in 2018, emphasises the development of renewables and energy storage, the cost of which is dropping on an annual basis.

The Greek ministry of energy recently submitted its National Energy and Climate Plan, which outlines a transition to a green economy, in particular noting a radical change of Greece’s energy mix in favour of renewables for up to 32% of final consumption.

Despite all the promise, so far, not a single well has been drilled in the west and south west of Crete.

However, Andriosopoulos says even as the share of renewables continues to grow, fuels such as oil and gas will continue to take up a large percentage in the energy mix for many years to come and “cannot be abandoned.”

But he cautions: “If developments in hydrocarbon exploration is too slow, it may then be too late to use these fuels; there is a time frame of a couple of decades for these projects, since their profitability may come into question as time passes,” he notes.

Future outlook

Overall, should there be a significant find offshore Greece, “the region as a whole could stand to benefit significantly,” says van der Meer.

But considering the current rate of activity, and the potential technical challenges associated with deepwater drilling, the time frame for such a discovery is likely to still be several years away.

Commenting on recent new lease agreements, Greek Energy Minister George Stathakis has said he expects to see “the extent and size of [Greece’s] deposits in two to four years.”