DEALS ANALYSIS

Deals activity: North America records flat growth; upstream leads by sector

Powered by

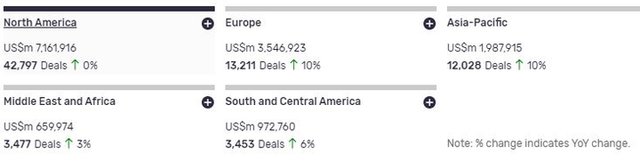

Deals activity by geography

Oil & gas industry deals, as captured by GlobalData’s Oil & Gas Intelligence Centre, are up year-on-year (YoY) across all regions.

North America is leading in terms of deal value but also recorded 0% YoY growth in deals volume. Asia-Pacific and Europe recorded the joint highest growth, seeing deal volume increase by 10% YoY.

The volume of deals recorded by GlobalData also increased in South and Central America, by 6%, and by 3% in the Middle East and Africa.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Acquisition | 4867 | 14583 | 50 |

| Debt Offering | 4495838 | 9111 | 16 |

| Asset Transaction | 2230170 | 25580 | 7 |

| Equity Offering | 1800502 | 15833 | -19 |

| Private Equity | 528045 | 2981 | 112 |

| Merger | 163950 | 518 | 1464 |

| Venture Financing | 29658 | 2346 | -15 |

| Partnership | 14607 | 3554 | 119 |

A breakdown of deals by type and volume shows very positive growth, with acquisitions up 50% YoY, partnerships up 119%, asset transactions up 7%, and mergers up an astonishing 1464%. Financing deals have fared somewhat more unevenly; equity offerings are down -19%, private equity is up 112%, venture financing is down -15% YoY, and debt offerings are up 16%.

Deals activity by sector

Perhaps the most notable trend apparent in GlobalData’s analysis of oil & gas industry deals by sector is consistency. The various sectors are maintaining their general rankings by volume from previous years, with upstream continuing to lead, with 884 deals logged, while petrochemicals remains the smallest sector by deals volume, with just 91.

Note: All numbers as of 7 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Oil & Gas Intelligence Centre.

Latest deals in brief

Gazprom Neft and Shell to work on hydrocarbon exploration and production

Russia’s Gazprom Neft and Shell have finalised an agreement to extend cooperation in upstream, technology and renewable energy.

Repsol to sells upstream assets in Malaysia and Vietnam

Repsol has agreed to divest its exploration and production assets in Malaysia and Vietnam, to Hibiscus Petroleum.

Diversified Energy to purchase Blackbeard assets in US

Diversified Energy Company has agreed to acquire certain upstream assets from Blackbeard Operating, for a gross purchase price of $180m.

Wintershall Dea divests entire stake in Wolgodeminoil JV

Wintershall Dea has divested its 50% stake in the Wolgodeminoil joint venture (JV) to its partner RITEK, a subsidiary of Russian oil firm Lukoil.

BP forms partnership to boost Clair field production in UK North Sea

BP has joined forces with Baker Hughes and Odfjell Drilling to improve production at the Clair oilfield in the UK North Sea.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.