PROJECTS

The cold thaw: inside Russia’s $300bn Arctic oil and gas investment

While investments in the North American Arctic remain frozen, Russia is doubling down on oil and gas in the region. Julian Turner talks to Canadian energy analyst Doug Matthews about budgets, blow outs, and what the oil price collapse could mean for Russian ambitions in the Arctic Circle.

Credit: Henning Flusund

In January, with the Covid-19 outbreak still in its infancy and oil prices relatively stable, Russian President Vladimir Putin bullishly announced $300bn of incentives for new oil and gas projects north of the Arctic Circle.

It comprises direct government investments in infrastructure – including the construction of 800km of new pipelines – significant tax breaks for exploration, production and shipment, and a ramping-up of activity by its oil and gas monopolies. The plan aims to increase Russia’s influence in the region, thought to be home to as much as $35tn worth of untapped oil and gas reserves.

On 5 March, Moscow published ‘On the Basics of State Policy of the Russian Federation in the Arctic for the Period Until 2035’, its 15-year Arctic masterplan. In addition to incentivising industrial development in the Russian Arctic and aggressively developing the country's Arctic energy resources, it proposes to boost the region’s population and greatly expand the use of the Northern Sea Route.

Just three weeks later, much of the developed world was in lockdown as a result of the Covid-19 pandemic, and at the time of writing oil prices have plummeted to their lowest mark in 18 years.

So what now for Russia’s hydrocarbon ambitions in the Arctic, including Rosneft’s giant Vostok Oil project, the ‘biggest in global oil’, which is expected to produce up to 100 million tons of oil a year?

Market condition: Arctic exploration vs the oil price

The short answer is that the current oil price may not be high enough to justify exploration costs.

Vostok Oil involves the construction of a seaport, 800 km of new pipelines, 15 new towns and a pair of airports. In October, the Kremlin announced a RUB1tn (approximately $40bn) tax cut, reportedly in response to demands by Rosneft’s CEO for preferential rates to attract investors.

As we are witnessing with the current price collapse, countries with significant oil and gas reserves can act to move the market down. However, Russia will likely need higher prices to make large-scale Arctic exploration and production projects viable – and those higher prices could in turn encourage key importers to return to North American shale resources, which are currently being abandoned.

Dominance in energy should also be read as dominance through energy

“In terms of global oil and gas prices, I don’t view Russian Arctic reserves as a significant advantage, although security of supply may become a problem for countries that tie their demand needs closely to Russian production,” comments Doug Matthews, a Canadian energy writer and analyst.

“We have seen this issue in Europe with the concern over Russian natural gas through Ukraine, and we may see China become more dependent on Russian oil, pipeline natural gas and liquefied natural gas (LNG).

“As Russia moves to become the major supplier in certain markets, it could hope to influence public policy in those countries through its control of supply. Dominance in energy should also be read as dominance through energy."

Rather than look abroad to the likes of Japan, India, China, and to a much lesser extent Canada for essential services such as shipbuilding, Matthews believes Russia’s long-term ambitions in the Arctic Circle will include increased investment in domestic industrial capacity.

“Russia will want to encourage the development of its own expertise, particularly in respect of ice-breaking capacity,” he says. “The leading edge Arctic expertise once enjoyed by Canada – think of the Father Lemeur ice-breaker – is now just a memory. With the shutdown of the Canadian Beaufort Sea in the 1980s, much of the expertise simply went away, never to return.”

President Vladimir Putin tours the Yamal LNG superplant. Image: Kremlin

Sea change: the importance of the Northern Sea Route

Russia’s broader plan to more than double maritime traffic in the Northern Sea Route (NSR) has both economic and symbolic significance for the country as it pushes to reassert itself in the Arctic Circle.

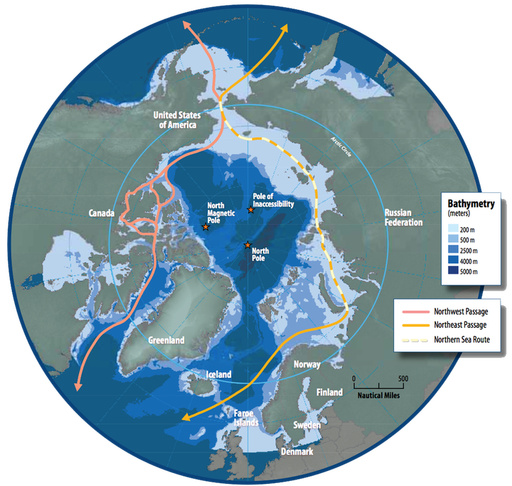

The NSR runs along the entirety of Russia’s territorial waters, from the Bering Strait between Siberia and Alaska to the Barents Sea, near Norway, and is inaccessible much of the year due to thick ice.

Russia has long sought to fully develop its NSR as a viable alternative to the Suez Canal

However, with ice sheets melting, and with significant investment in infrastructure, Russia hopes it will rival the traditional Europe-Asia sea route transporting goods and resources via the Suez Canal, including services for the Yamal LNG superplant based in the Yamal Peninsula above the Arctic Circle.

“Russia has long sought to fully develop its NSR as a viable alternative to the Suez Canal,” confirms Matthews. “The more the government can increase shipping through the NSR – in this case by supporting and shipping its own oil and gas resources – the more credible the route becomes to other potential shippers.

“So, we have a symbiotic situation where Russia's oil and gas companies can use the NSR to move their Arctic resources, which have been locked until now, while the NSR can show the world it is a credible route by increasing this domestically sourced traffic.”

Russia plans to more than double maritime traffic on the Northern Sea Route.

Cold comfort: the environmental risks of Arctic E&P

The question remains as to why Russia appears to be doubling down on fossil fuel exploration in the frozen north at a time when the likes of Canada and the US have their plans in the region on ice.

“The easy answer would seem to be that Russia has less strict environmental regulations governing Arctic exploration compared with Norway, Canada and, until recently, the US,” Matthews says.

“On the other hand, if the world is indeed transitioning away from fossil fuels, countries with vast reserves and the need for foreign exchange could be incentivised to produce at a full pace now, in advance of the coming demand destruction.”

The technical and environmental challenges of Arctic oil and gas exploration are well-documented. Previous attempts have ended ignominiously; in 2013, less than a year after a 30-mile-long ice floe forced Shell to shut down its Burger-A well after just 24 hours, the Anglo-Dutch multinational announced that, as a “precautionary measure”, it was suspending offshore drilling in Alaska.

Arctic exploration and the environment would appear to be a zero sum game

Two years on it pulled out altogether, having spent an estimated $7bn on exploration in the region. According to Matthews, the environmental risks to both Russian and Canadian waters are very real.

“Arctic exploration and the environment would appear to be a zero-sum game,” he states. “The greater the Arctic exploration and development activity, the greater the odds for incidents. We need only look at Shell Oil's less than stellar performance in the Chukchi Sea.

“The problem is, to turn an old phrase, ‘what happens in the Arctic doesn't stay in the Arctic’. An oil spill in the American Beaufort, for example, could impact its Canadian neighbour, and any blow out in Russia's Arctic will see oil, associated gas, and pollutants flow to other countries.”