Comment

Big Oil is dreaming big with digital twin technology, as Giacomo Lee reports.

GlobalData’s latest report, 'Unconventional Production in the US Lower 48, H1-2021' provides a comprehensive review of the shale oil and gas appraisal and development activity across major plays in the US Lower 48 region during H1 2021.

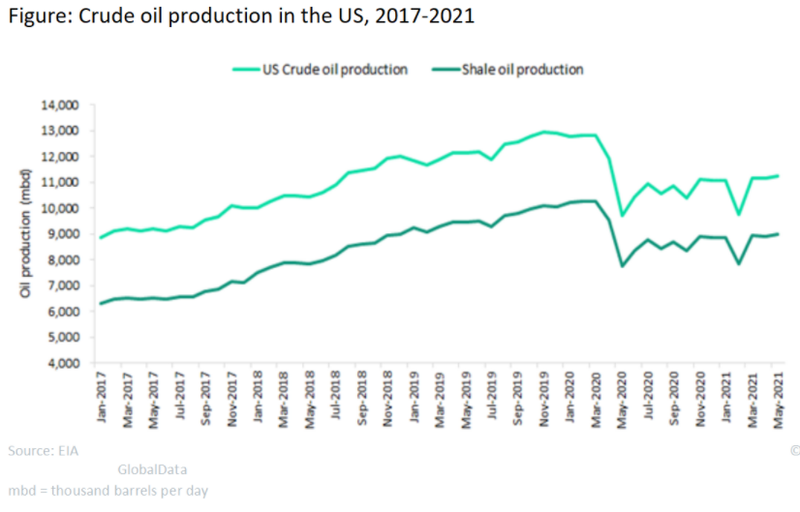

Crude oil production in the United States rose steadily over the past five years before the Covid-19 outbreak and reached almost 12.82 million barrels per day (mmbd) in February 2020. However, the Covid-19 pandemic significantly impacted oil prices as energy demand collapsed all over the world. Thus, shale oil production in the US fell drastically during H1 2020 to 9.7 mmbd.

In the second half of 2020, prices started to slowly climb up and in January 2021 the WTI price benchmark reached $57 per barrel, thereby encouraging shale drillers to lift their output.

Unfortunately, in mid-February 2021 another event created disruptions to drilling activities in the central part of the United States. Many states, including Texas, were hit by severely cold weather causing frozen wells and pipelines. As a result, crude oil production during that month fell by almost 1.2 mmbd, while natural gas output plummeted by more than 3,000 mmcfd in the Permian alone. As temperatures started to rise, production in March 2021 almost recovered to January levels.

Despite quite significant increase in oil prices, operators have been quite prudent in their capital spending and started building their strategies around high-return core assets. As a result, total rig count in the US has been quite sluggish in response to increase in WTI price and is still at 63% level compared to the number of rigs before the pandemic started.

Nonetheless, there are more than 5,000 operators drilling in the Permian Basin, Eagle Ford, Bakken, and other shale plays. Companies were able to reach significant drilling and completion improvements, lowering break-even price of unconventional projects to as low as $35 per barrel. Shale production in the country is expected to rebound to pre-pandemic levels by 2024.

Main image: Port Aransas, TX. Credit: Edgar Lee Espe / Shutterstock.com

US shale production to reach pre-pandemic levels over the next four years