- ECONOMIC IMPACT -

Latest update: 21 July

Many economists have cut their GDP forecasts. The 2020 consensus forecast for GDP growth is currently negative and many predict a recession.

Major market indices are improving and, while concern over Covid-19 remains volatile, business optimism continues to improve.

5.9%

The Israeli Finance Ministry expects its economy to contract by 5.9% in 2020;

further lockdowns could cause the economy to fall by 7.2%.

-4.7%

The IMF estimates growth of -4.7% for the Middle East and Central Asian region.

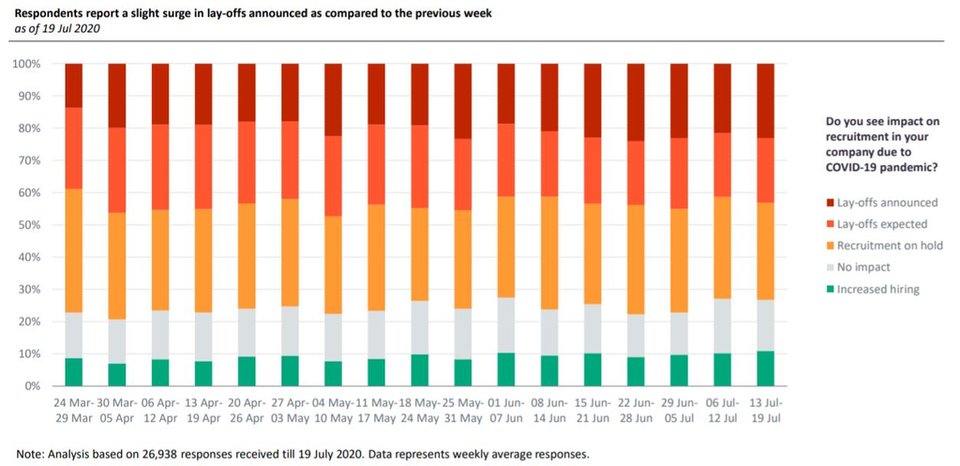

Impact of Covid-19 on employment

- SECTOR IMPACT: oil & gas -

Latest update: 15 July

GlobalData analyst view:

"The oil & gas industry has been heavily impacted on all fronts as falling demand and geopolitical ambitions are greatly impacting company finances. The upstream sector will bear the brunt of the Covid-19 outbreak as the falling oil prices will impact production economics."

Global oil and gas demand remains uncertain in the near term as a resurgence of COVID-19 infections may force countries to re-impose partial lockdowns.

After a 16 % year-on-year fall in Q2, IEA expects a slight

improvement in oil demand during H2 2020.

However, oil prices are likely to remain under pressure and would significantly impact company revenues – BP Plc anticipates a $17.5bn write down in Q2 due to low prices.

impact on capital expenditure