Deals in brief

Powered by

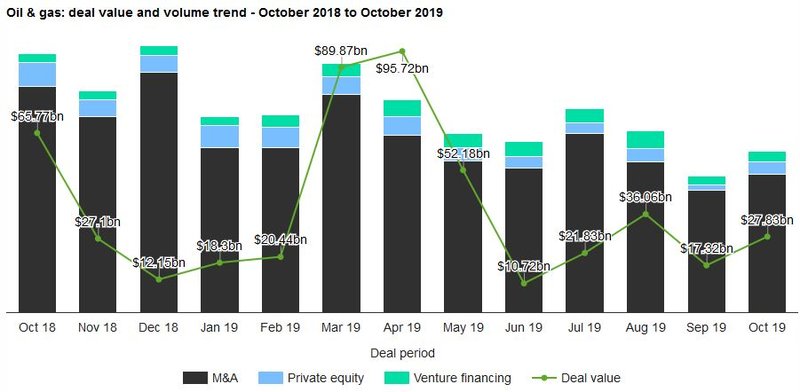

Oil & gas industry deals in October 2019 total $27.83bn globally

Total oil & gas industry deals for October 2019 worth $27.83bn were announced globally, according to GlobalData’s deals database.

The value marked an increase of 60.7% over the previous month and a drop of 28.9% when compared with the last 12-month average of $39.14bn.

In terms of number of deals, the sector saw a drop of 21.3% over the last 12-month average with 148 deals against the average of 188 deals.

In value terms, North America led the activity with deals worth $19.94bn.

Oil & gas industry deals in October 2019: Top deals

The top five oil & gas deals accounted for 52.4% of the overall value during October 2019.

The combined value of the top five oil & gas deals stood at $14.59bn, against the overall value of $27.83bn recorded for the month.

The top five oil & gas industry deals of October 2019 tracked by GlobalData were:

1) Hess Midstream Partners’ $6.2bn acquisition of Hess Infrastructure Partners

2) The $2.65bn asset transaction with Indigo Natural Resources and Momentum Midstream by DTE Energy

3) Parsley Energy’s $2.27bn acquisition of Jagged Peak Energy

4) The $2bn acquisition of Dominion Cove Point LNG by Brookfield Asset Management

5) Santos’ asset transaction with ConocoPhillips for $1.47bn.

Gazprom to offer second public offering of shares in 2019

Russian gas company Gazprom has authorised the sale of 3.6% of its shares in its second public offering this year, according to a report by Reuters.

This is in order to complete the sale of its “quasi-treasury” shares, which do not have dividend payments on them.

Gazprom stated that it would sell 850.6 million ordinary shares in Moscow today, with the stake estimated to be worth RUB211bn ($3.3bn), based on Gazprom’s share price of RUB248 ($3.89) on Wednesday 20 November.

Total sells stake in offshore Brunei block to Shell for $300m

French integrated oil and gas company Total has signed an agreement to sell wholly owned subsidiary Total E&P Deep Offshore Borneo (TEPDOB) to oil and gas firm Shell for $300m.

The subsidiary holds an 86.95% stake in Block CA1, which is located 100km off the coast of Brunei. Stretching across an area of 5,850km2, the block is currently operated by Total alongside partners Murphy Oil and Petronas. Murphy Oil holds 8.05% interest and Petronas holds 5% ownership in the Brunei block.

Udenna to buy Chevron’s share in Malampaya gas field

Philippines based company Udenna Corporation has purchased Chevron’s 45% stake in the Malampaya gas field off the coast of the island of Palawan for an undisclosed fee. Udenna will acquire the shares through its subsidiary UC Malampaya Philippines, whilst Chevron will sell its stake through its own subsidiary Chevron Malampaya. The deal is subject to regulatory approvals in the Philippines.

Ithaca Energy completes $2bn sale of Chevron North Sea

UK-based oil and gas operator Ithaca Energy completed its acquisition of Chevron North Sea for $2bn. The acquisition was announced in May 2019 and effective from 1 January 2019. The deal has added ten producing field interests to Ithaca’s portfolio, which amounts to a 300% increase in the company’s forecast 2019 production and a 150% increase in its proven and probable reserves.

MOL to acquire stakes in Azerbaijan’s ACG field and BTC pipeline

MOL Group has signed an agreement with Chevron Global Ventures and Chevron BTC Pipeline to acquire their non-operated E&P and mid-stream interests in Azerbaijan for $1.57bn. MOL will purchase 9.57% stake in the Azeri-Chirag-Gunashli (ACG) oil field and 8.9% stake in the Baku-Tbilisi-Ceyhan pipeline which transports crude to the port of Ceyhan. The transaction will make MOL the third largest field partner in ACG.