- ECONOMIC IMPACT -

Latest update: 16 August

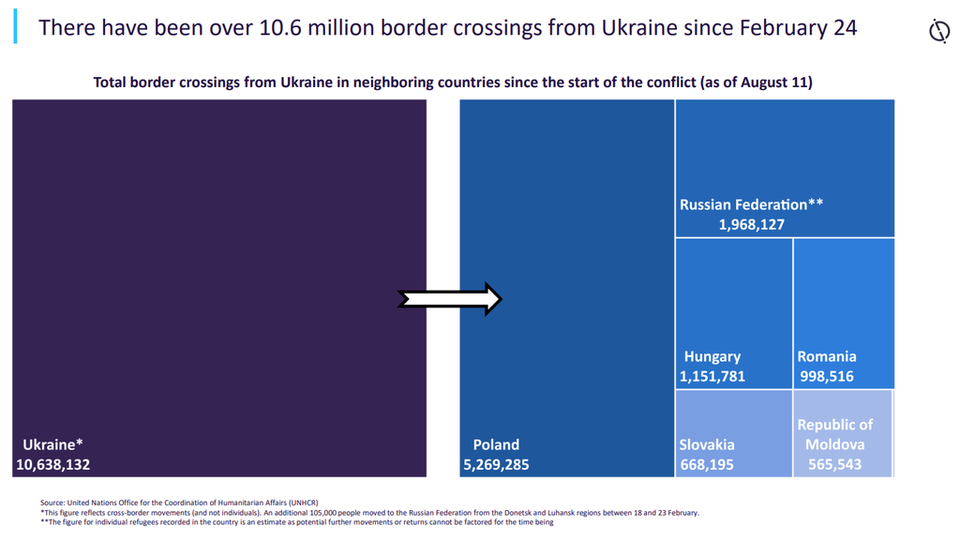

Data from the United Nations’ Refugee Agency indicates that over 10.6 million people have crossed the Ukrainian border as of August 10, while 3.8 million have returned.

The World Bank lowered its global growth forecast from 4.1% to 2.9%. Against this backdrop, GlobalData now forecasts that the world economy will grow at just 3.1% in 2022, following 5.9% growth in 2021.

In a bid to undermine Russia’s economy, the US and its allies have disconnected key sanctioned Russian banks from global financial system SWIFT. Moreover, they have agreed to prevent the Russian central bank from deploying its $661.8bn of international reserves.

The EU continues to be the biggest importer of Russian hydrocarbons. Nevertheless, its latest batch of sanctions are aimed at phasing out Russian oil imports via tankers by year end. This move might reduce the region’s dependency on Russia.

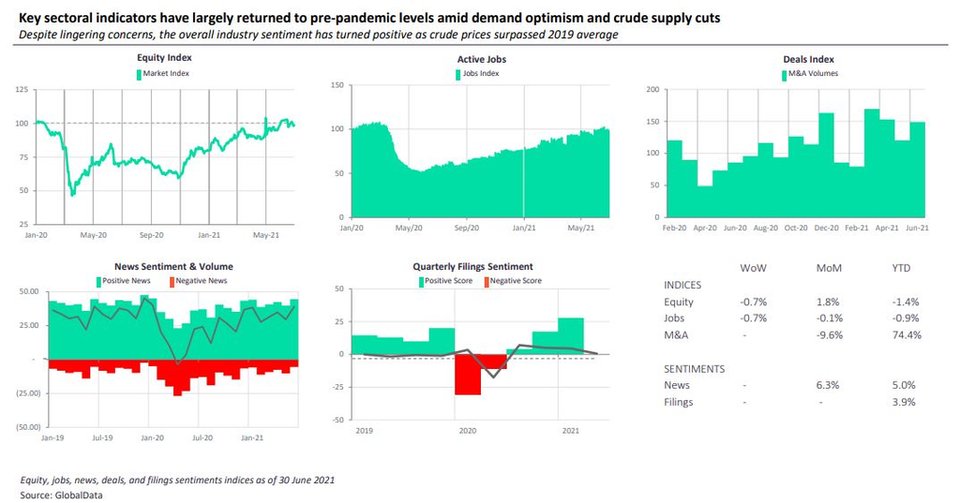

Covid recovery in the Americas

- SECTOR IMPACT -

Latest update: 16 August

REVENUE PREDICTIONS

Global oil and gas prices, which were already at its highest levels since 2014 amid crude supply constraints, have risen further since the start of the Russia-Ukraine war. Gas prices in Europe peaked in March and are currently on the rise in the summer.

SUPPLY CHAIN DISRUPTION

In the short term, gas supplies have increased, but risks to this trade pose a threat to European gas supplies. In the medium to long term, Europe will try to decouple itself from Russian gas.

CAPEX REALIGNMENT

Over $160bn worth of projects are under development in Russia. Imposition of sanctions and subsequent exodus of foreign companies could hamper project financing in the country. In one such case, TotalEnergies has decided to stop financing all new projects in Russia.

SANCTIONS

Sanctions on Russia’s banks using the SWIFT system have so far excluded energy payments from their scope, thus allowing payments for Russian oil and gas to continue.