Regional Focus

Bedlam in the Bight: what will Australia’s new government mean for offshore oil?

Not known for his sympathetic view on climate change, Australia’s new Prime Minister faces some tough decisions in light of his re-election, and right at the top of the energy agenda is what to do about controversial plans to drill for oil in the Great Australian Bight. Andrew Tunnicliffe finds out more.

Credit: Courtesy of Greenpeace

"I

’ve always believed in miracles” newly re-elected Australian Prime Minister Scott Morrison told gathered supporters at is victory speech after confounding pollsters and winning power in the country’s general election in May. For months his Liberal-National coalition government had been behind Labor in the polls, with the expectation it would be defeated.

Like much in Australian politics today, the election campaign was loud, sometimes chaotic, with copious issues of local and national interest occupying much of the narrative. But at the heart of the debate were economics and climate change, despite Morrison’s attempts to silence climate rhetoric.

“Australia has been devastated by multiple climate disasters recently,” says Nathaniel Pelle, senior campaigner for Greenpeace Australia Pacific. “From the fires in Tasmania to the drought in the interior, the heatwaves in our cities, the bleaching of the Great Barrier Reef, and the storms and floods in Queensland, climate damage is hurting Australian families and is destroying the places we love.”

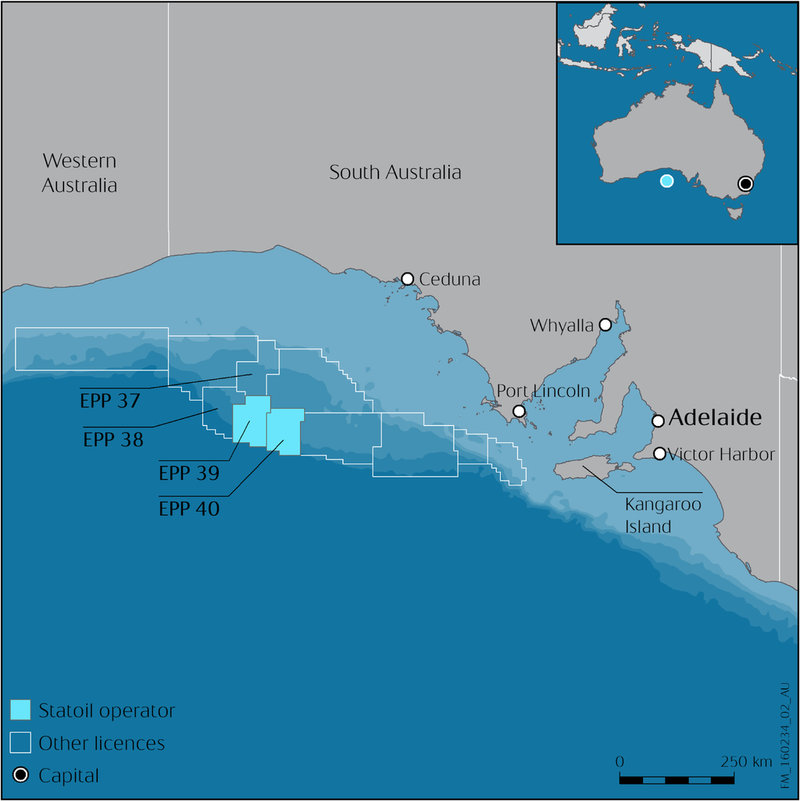

One major issue for the 16 million-strong electorate was the Great Australian Bight, a 720 mile stretch of ocean off the southern coast of Australia. Norwegian-based energy giant Equinor ASA, formally Statoil, has proposed a drilling programme, Stromlo-1, currently being considered by Australia’s National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) in the Bight.

Whales in the Great Australian Bight. Image courtesy of Greenpeace

Stromlo-1: a controversial project

The proposed well is situated 231 miles off the southern coastline and 296 miles west of Port Lincoln. The global energy provider secured rights for exploration in the area back in 2017 after securing a swap agreement with BP for rights to the permit, but has faced significant public opposition ever since. Then the company said it believed Stromlo offered “high-impact potential in a frontier exploration setting”.

While concerns date back further than 2017, just days before the recent election a group of prominent individuals, including Her Majesty Queen Noor of Jordan, Jane Goodall and Richard Branson, called on both sides of the political debate to protect the region from the prospect of drilling. In an open letter, the so-called Ocean Elders said: “If we are to meet the Paris Climate Accord to limit global warming to less than 1.5 degrees, it is essential that we do not open up new fossil fuel reserves, let alone in extremely dangerous and high conservation value environments such as the Bight.”

Their concerns are supported by Greenpeace. “The Great Australian Bight is one of the world’s most remarkable ocean areas, a pristine wilderness including hundreds of kilometres of towering cliffs and home to a critical whale sanctuary, tight-knit coastal communities and fishing towns, hundreds of world-class surf beaches, and more unique species than the famous Great Barrier Reef,” says Pelle.

Equinor has worked hard to address the concerns of Greenpeace, the Ocean Elders and the Australian public.

Acknowledging the plan has been delayed a few times, Pelle says the threat of drilling remains high. However, Equinor has worked hard to address the concerns of Greenpeace, the Ocean Elders and the Australian public. Releasing a draft Environmental Plan open to public consultation earlier this year, the company’s Australian manager, Jone Stageland, said: “Over the last two years we have engaged with more than 100 different organisations in the South Australian community and they have consistently asked us to be open about our plans. We have listened.”

The plan details what Equinor says are “all relevant risks, however unlikely”. It’s not enough, however, according to Pelle: “The plan [Equinor] has put forward falls well short of global best practice, and when combined with the extraordinary risks that prevail in the Bight due to adverse conditions and a lack of infrastructure, the threat is very real.” He added the company’s own modelling shows the project “poses a serious threat to Australia’s beaches in the case of an oil spill”.

Image courtesy of Equinor

Regional competition is stiff

While there have been several notable gas discoveries in the East Med - including Tamar (7-10tcf) and Leviathan (18.9tcf) fields in Israel and the Aphrodite (~7tcf) and Calypso gas fields in Cyprus, as well as the more recent ones - as noted by Morris, many face challenges commercialising amid challenging access to the European gas market and geopolitical tensions.

Cyprus, for example, is currently considering export opportunities to Europe via a new LNG plant or a new gas pipeline - both of which will probably require more gas to be discovered to make the investment commercially viable.

Whereas gas found offshore Greece, which borders Albania and Bulgaria, has an easy overland route to the rest of the European market, where gas is a core part of the energy mix.

While natural gas demand in Europe is levelling off amid more renewable energy production, supply is also declining. The EU currently imports about 20% of its gas needs, mostly from Russia, and is keen to find new supplies.

“The addition of an entirely new productive gas region would be huge news for Europe,” says Professor Kostas Andriosopoulos, an academic director at ESCP Europe.

“If we take into account Greece's proximity to the Balkan markets, dominated by Russian oil and gas, new discoveries would also bear fruit when it comes to their energy independence.”

Furthermore, Greece itself would benefit through the reduction of gas imports from places like Russia and Algeria, while local consumers could enjoy lower prices, he adds.

Falling oil prices – over an extended period of time – and a rise in the demand for renewable sources will shape the industry of tomorrow.

While there have been several notable gas discoveries in the East Med - including Tamar (7-10tcf) and Leviathan (18.9tcf) fields in Israel and the Aphrodite (~7tcf) and Calypso gas fields in Cyprus, as well as the more recent ones - as noted by Morris, many face challenges commercialising amid challenging access to the European gas market and geopolitical tensions.

Cyprus, for example, is currently considering export opportunities to Europe via a new LNG plant or a new gas pipeline - both of which will probably require more gas to be discovered to make the investment commercially viable.

Whereas gas found offshore Greece, which borders Albania and Bulgaria, has an easy overland route to the rest of the European market, where gas is a core part of the energy mix.

While natural gas demand in Europe is levelling off amid more renewable energy production, supply is also declining. The EU currently imports about 20% of its gas needs, mostly from Russia, and is keen to find new supplies.

“The addition of an entirely new productive gas region would be huge news for Europe,” says Professor Kostas Andriosopoulos, an academic director at ESCP Europe.

“If we take into account Greece's proximity to the Balkan markets, dominated by Russian oil and gas, new discoveries would also bear fruit when it comes to their energy independence.”

Furthermore, Greece itself would benefit through the reduction of gas imports from places like Russia and Algeria, while local consumers could enjoy lower prices, he adds.

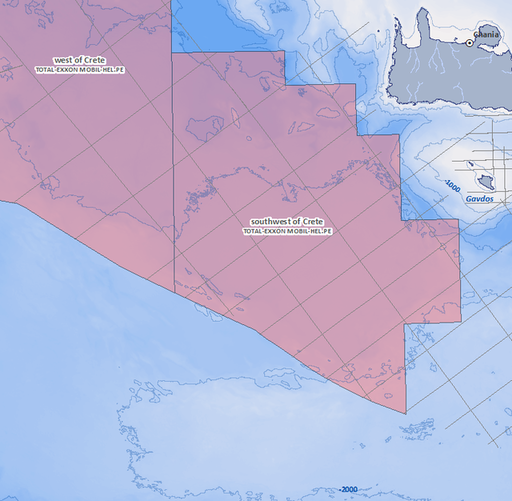

Credit: Courtesy of Hellenic Petroleum

Ongoing Challenges

Despite all the promise, so far, not a single well has been drilled in the west and south west of Crete - so what is holding back serious activity?

Edgar van der Meer, senior analyst at NRG Expert, says investors may still be wary of the financial stability in the Greek economy, as well as the political risks, coupled with the unknown quantity and quality of potential resources, meaning investment in the area ‘is deemed risky.’

“Greece has had a very unstable political and economic climate, which has detracted and deterred foreign investment,” he says.

Another issue is a lack of momentum from the government, say Morris.

“When blocks are awarded they need to go through a ratification process to confirm the awards but that can take up to two years; it is not a fast process and there are many environmental and permitting considerations that add to the timeline,” he explains.

HHRM, the public authority in charge of hydrocarbons resources management, could use more support for staff and money too, says Andriosopoulos.

“Another important challenge is modernising the terms offered for future contracts to reflect the realities in the market; only then will investors be interested in hydrocarbon exploration and production in Greece,” he adds.

While the Greek government has acknowledged the importance of competitiveness and investment in its offshore energy sector, especially after the decade-long economic crisis, Andriosopoulos, says: “More political will is required to support the set goal of turning the country into an energy hub and realising the energy and climate goals for 2030.”

Sanzillo urges oil and gas companies to begin thinking about their future investment in research and development and where that finance and expertise should go.

Part of that strategy is partnering with governments to prepare the economy for tomorrow.

“Norway is at least beginning to talk about it,” says Sanzillo. “In the US, when defence plants close, we mobilise the entire economy in order to make sure there is a smooth transition for workers and the communities where those closures are taking place – changes in the fossil fuel sector will be even bigger.”

Despite the need for a refocus Sanzillo speak of, he’s positive about the industry’s ability to change: “Amongst other things, large oil and gas companies are like universities. They are research universities that have great capacity to do great things, they already have. They have the capability and have been a major driver of the world for decades. You hope they can do that again, just without destroying the planet.”

Stromlo-1 hit hard by election

As election day neared, public pressure forced the hand of the Government. Labor had already announced it would hold an inquiry into the impacts of offshore oil drilling in the Bight. As polling showed the Bight was a major issue in some marginal seats in South Australia and Victoria – 60% of Australians oppose the project – the now re-elected Coalition also pledged to hold an inquiry into the process around approving the drilling, overseen by NOPSEMA.

“The election was bad news for Equinor despite the re-election of the Coalition, with both major parties committing to new regulatory hurdles for drilling in the Bight,” says Pelle. “The Federal Government has committed to a review led by Australia’s Chief Scientist Alan Finkel, which will involve increased scrutiny of Equinor’s plans and the adequacy of Australia’s regulatory regime.”

Equinor’s Environmental Plan received more than 30,000 comments from the public, raising concerns on climate change, environmental impact and safety. In response it said it would produce a public report on how it planned to mitigate those concerns, although it added many of the comments “do not offer constructive feedback”.

It’s hard to see how Equinor can continue to face down criticism of its plans.

It’s hard to see how Equinor can continue to face down criticism of its plans. “At present, 19 local councils Australia-wide… oppose oil exploration in the Bight, recognising that the future economic and social prosperity of the region depends on a clean and beautiful environment,” continues Pelle.

“We believe the weight of public opposition will see this project abandoned and will continue to fight toward that outcome. The public opposition is strong enough that both sides of politics have recognised that the oil industry will never gain a social licence to operate in the Bight.”

It’s not just oil occupying the mind of the electorate. Other fossil fuels such as coal, for which Morrison has long supported, are beginning to gain significant political traction.

“Scott Morrison’s Coalition government will now need to urgently stake out a credible pathway for reducing greenhouse gas pollution in Australia if we are to meet the Paris Accord. Climate change may not be Mr Morrison’s natural issue, but destiny has knocked, and he needs to take up the challenge urgently,” Pelle says.

Future outlook

Overall, should there be a significant find offshore Greece, “the region as a whole could stand to benefit significantly,” says van der Meer.

But considering the current rate of activity, and the potential technical challenges associated with deepwater drilling, the time frame for such a discovery is likely to still be several years away.

Commenting on recent new lease agreements, Greek Energy Minister George Stathakis has said he expects to see “the extent and size of [Greece’s] deposits in two to four years.”